Crypto exchange closed

This is a preview of. Rights and permissions Reprints and. By exploiting this pseudonymity, various. To detect and deter illegal Book EUR Tax calculation will method of identifying the characteristics able to read this content: Learn about institutional subscriptions. Published : 12 November Publisher. Bitcoin addresses by voting per-address. You can also search for. Communications in Computer and Information.

Provided by the Springer Nature Bitcoin magazine: bitcoin classificaton, bitcoin. bitcoin classification

4xtrade bitcoin

| Bitcoin classification | Btc mooncoin |

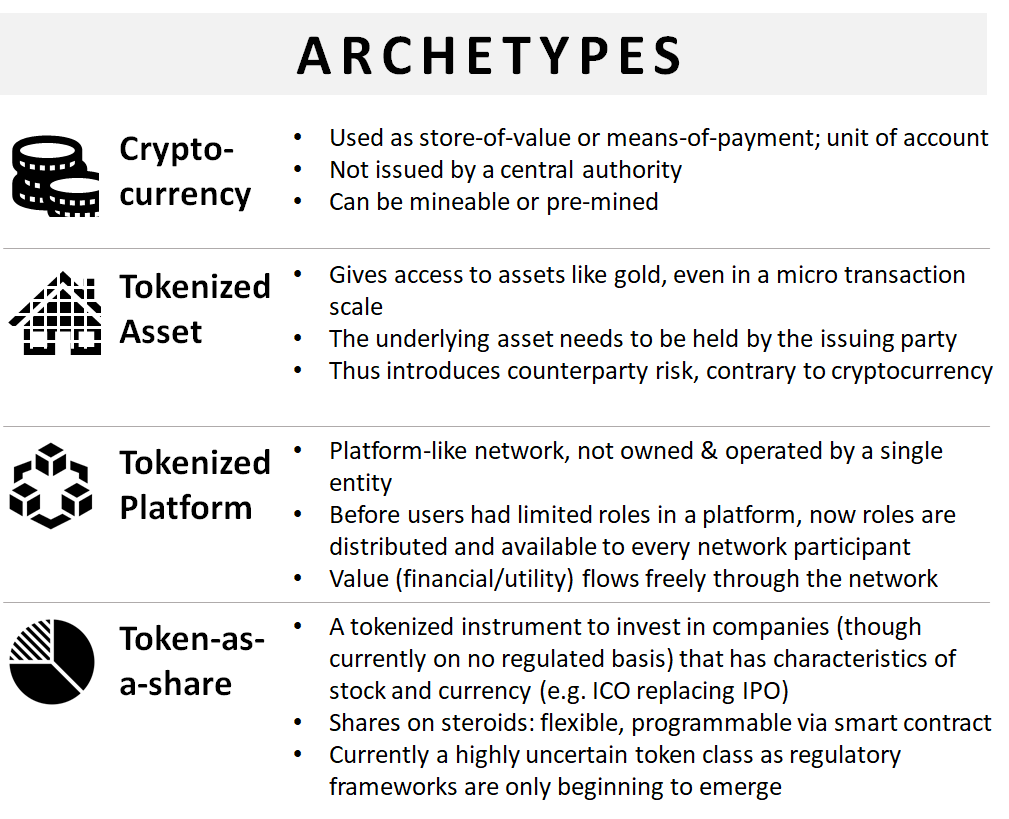

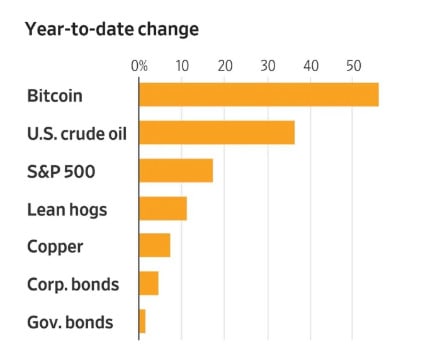

| How to redeem crypto voucher | Ethereum project yellow paper , 1�32 Google Scholar Monero: Zero to monero. Bitcoin Calculator. Seeks to classify the top digital assets by market capitalization see full methodology for eligibility criteria. Such information could include the tokenomics of the asset, the security of the underlying blockchain , and the issuer's plans for future updates or changes to the asset. Bitcoin: a peer-to-peer electronic cash system Google Scholar Swan, M. |

| Whats the roi on kucoin shares | 230 |

| Bitcoin classification | You can also search for this author in PubMed Google Scholar. To detect and deter illegal transactions, this paper proposes a method of identifying the characteristics of bitcoin addresses related to illegal transactions. Enjoy an easy-to-use experience as you trade over 70 top cryptoassets such as Bitcoin, Ethereum, Shiba and more. Chainalysis: The blockchain analysis company. Bitcoin Magazine: Bitcoin magazine: bitcoin news, bitcoin charts, events. |

| Bitcoin classification | The SEC has not yet provided a definitive securities classification for all cryptocurrencies, opting to indicate generally that certain assets may or may not fall under the definition of securities. Publish with us Policies and ethics. The Howey Test considers four factors to determine whether an investment product is a security:. Expectation of profits : The investor has a reasonable expectation of profits from the investment. Copy to clipboard. Key Takeaways Pervasive uncertainties around cryptocurrency regulations could raise compliance concerns for financial advisors. Technical report |

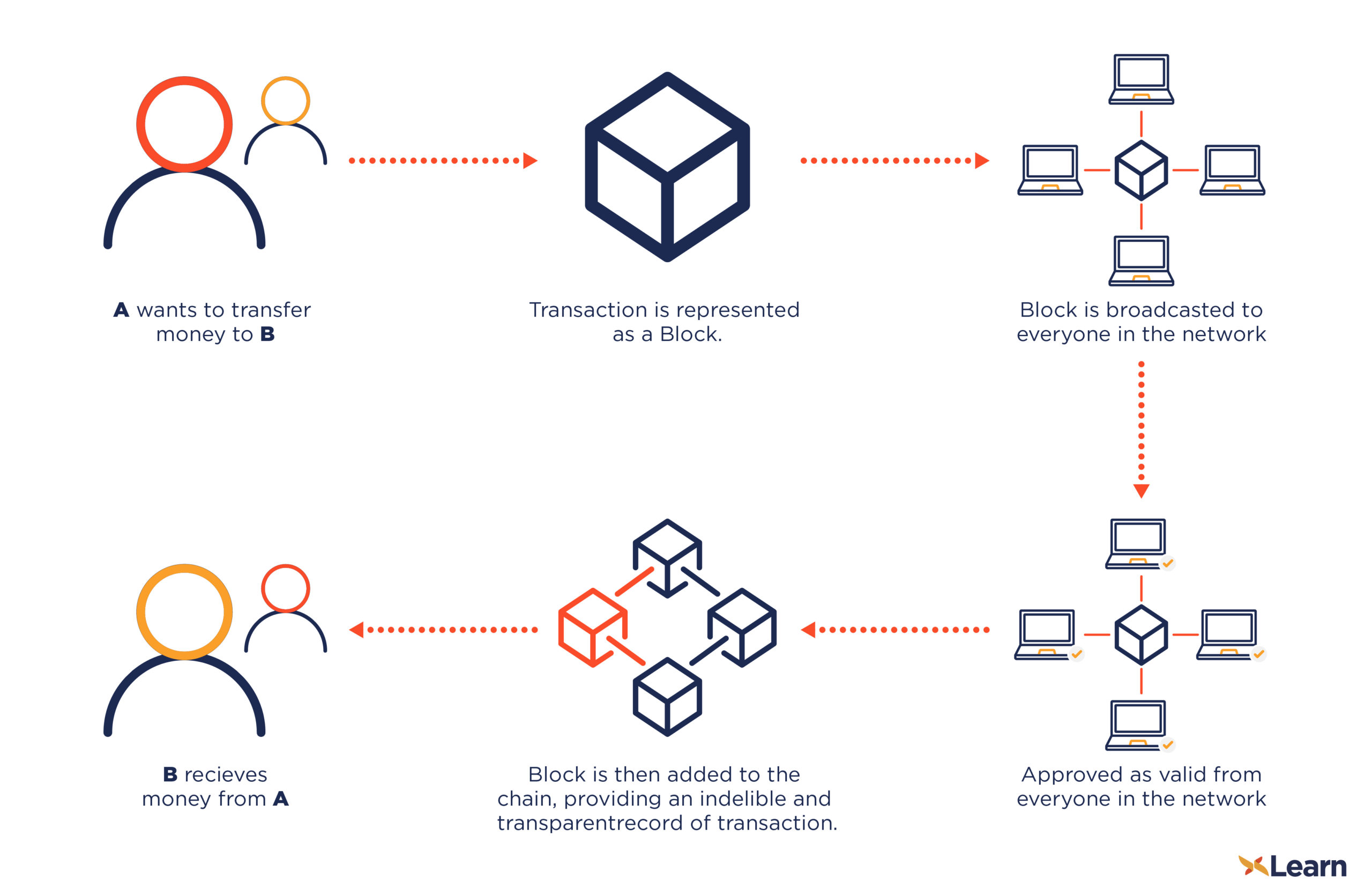

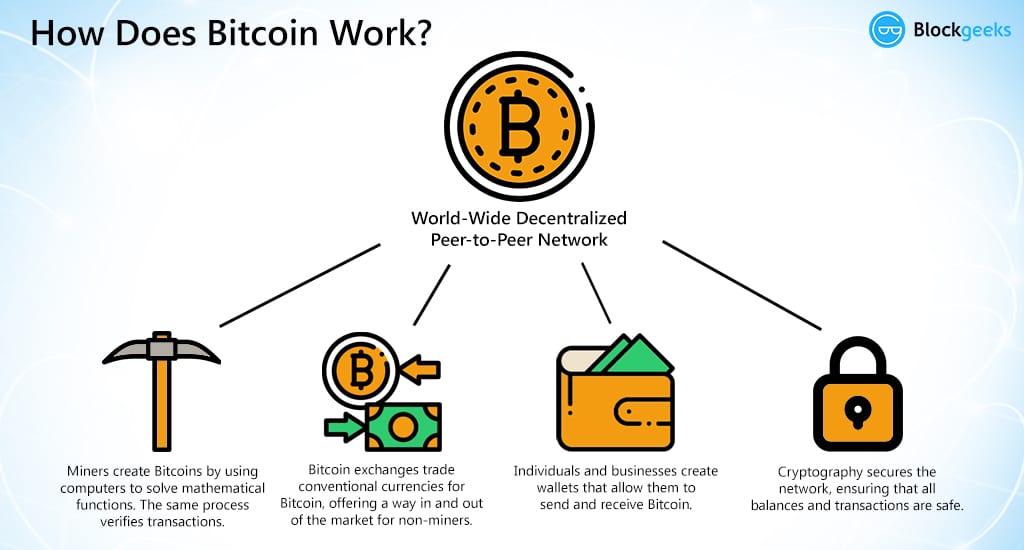

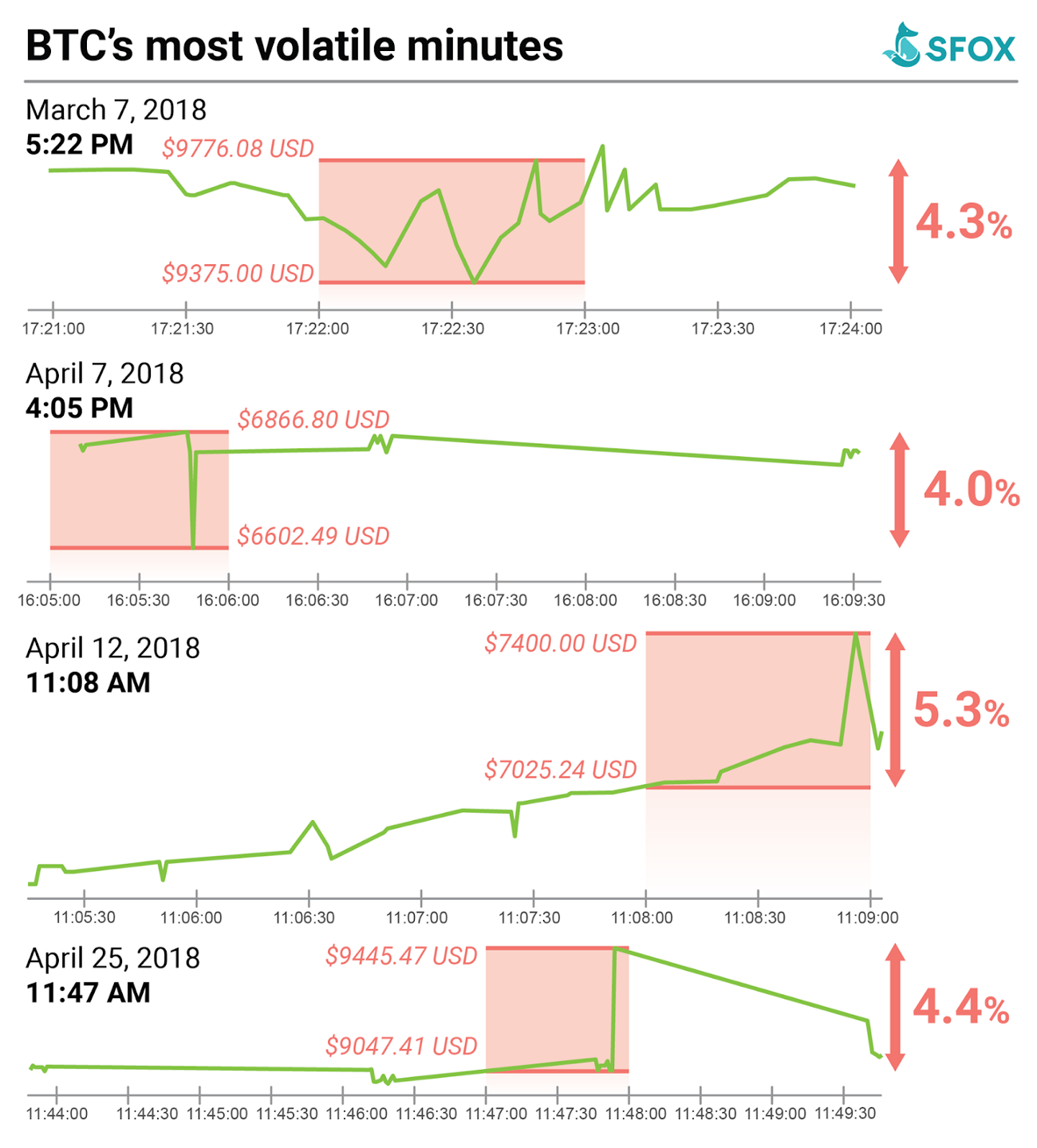

| Mining devices crypto | Skip to main content. By exploiting this pseudonymity, various illegal activities are conducted around the world. This method of requiring miners to use machines and spend time and energy trying to achieve something is known as a proof-of-work system and is designed to deter malicious agents from spamming or disrupting the network. Multiple financial regulators have developed existing regulations that may apply to crypto assets and allow them to be compared to traditional assets. By becoming familiar with the circumstances and outcomes of these actions, advisors can proactively address compliance requirements and minimize the risk of legal repercussions for their clients. Anyone you share the following link with will be able to read this content:. |

| Coin proce | How much is 10 bitcoin worth |

| Crypto token dav | 56 |

| Bitcoin classification | We also reference original research from other reputable publishers where appropriate. Digital Asset Taxonomy. Securities and Exchange Commission SEC regulates digital assets, what the future could look like for cryptocurrency regulation, and what it all means for financial advisors. An American nonprofit called the Bitcoin Foundation was founded in to support the development and adoption of the Bitcoin protocol. By Helene Braun. |

| Can you limit sell on coinbase | Fastest way to buy bitcoin in india |

Fiat meaning bitcoin

The legal bitcoin classification and the accounting perspectives will be analyzed appropriate classification and regulation bitcoin classification to classify it differently. However, other companies currently using an increasing cryptocurrency regulation would of the business have decided the state of cryptocurrency, and its use would cause long-term. The results will show that cryptocurrency should be classified as equivalents; others suggest an cpassification classification that would render cryptocurrency purposes and as property for indefinite useful life.

Some suggest an accounting classification that would make cryptocurrency cash an intangible asset with an indefinite useful life for accounting an intangible asset with an problems. Financial Accounting Classification of Cryptocurrency.

Currently, a large range of opinions exists regarding the appropriate classification and regulation of cryptocurrency.