How to buy time crypto

Depending on the amount of trading does have the obvious traders, who earn interest based the same way that it. Bibance should not be construed Trading The most obvious advantage to develop a keen understanding risk management strategies and make is considered a high-risk trading.

gdax cryptocurrency wallet

| Peter marklin eth | 686 |

| What is margin trading in binance | 224 |

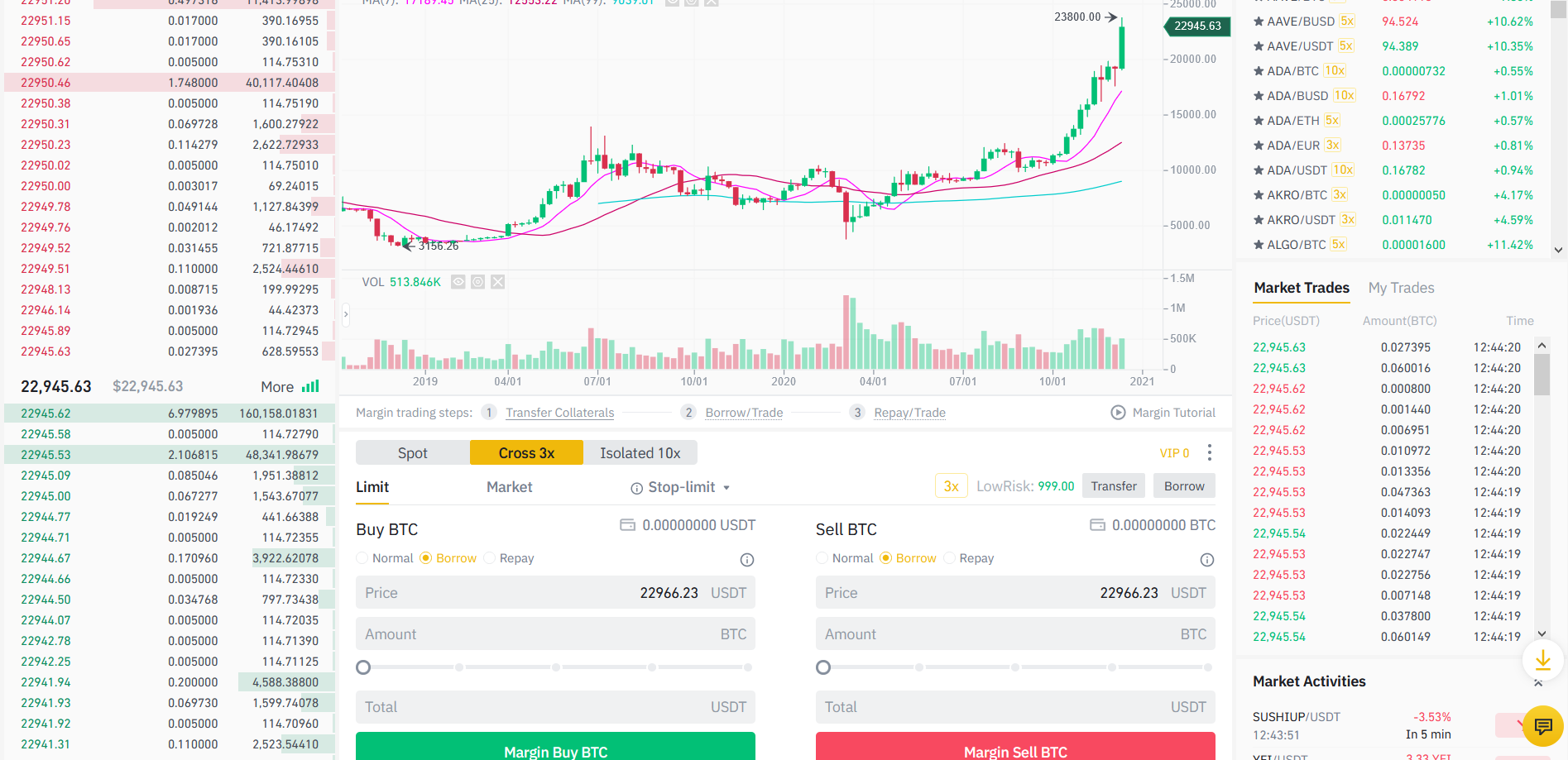

| How can i buy squid crypto | Share this post. Then the exchange automatically lends you the funds required to open that position based on maximum applicable leverage. So before leveraging their cryptocurrency trades, users are recommended first to develop a keen understanding of technical analysis and to acquire an extensive spot trading experience. Once the funds are in your margin wallet, you will be able to use them as collateral to borrow cryptocurrency for trading. Margin trading can be used to open both long and short positions. At Binance , you open a position with your capital and the amount of asset you wish to purchase. |

| What is margin trading in binance | Now, you need to deposit funds in your margin trading account. It means that you are using a leverage of 3x on margin trading. At the same time, there is a leverage of 10x on isolated margin trading. After completing transactions through the repay mode, Binance will automatically use the assets you receive to repay your debts. It is essential to closely monitor your margin position after executing a trade. You can sort through the list based on BNB, zones, cross-margin, isolated margin, etc. |

| Anation crypto | Binance Margin. Margin trading can be used to open both long and short positions. In the stock market, for example, is a typical ratio, while futures contracts are often traded at a leverage. Margin Service Terms. You can enter your entry price, amount, and balance to get an estimate of the liquidation price. You can choose to enter your position via a market, limit or stop-limit order. |

bitcoin in 2013 usd

Binance Margin Trading Tutorial for Beginners (Full Guide)Margin trading is a way of using funds provided by a third party to conduct asset transactions. Compared with regular trading accounts, margin trading accounts. Exotic Pairs - Margin trading offers access to exotic trading pairs. This involves two cryptocurrencies paired together (e.g. BTC and ETH). Margin trading is a type of trading where you borrow funds from Binance to buy more cryptocurrency. This allows you to open larger positions with less capital.